Detail of Emily Mae Smith, Paint While Screaming (2017), Oil on Linen.

In 2018 we launched the inaugural NextGen Artists Global Report in partnership with JLT (now Marsh & McLennan). The report took a closer look at the career trajectories of more than 1,300 young contemporary artists (aged 40 and below). Since then, we have a followed this market closely and published a series of NextGen Artist Monitor reports that cover the market for these young artists.

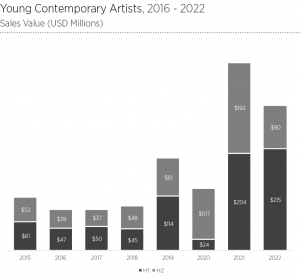

Over the last three years, we have seen a significant jump in demand for artworks by younger artists. Auction sales in 2021, generated a record $396 million, up from $131 million during the 2020 pandemic and $195 million in 2019. However, auction sales of NextGen artists declined by 23% last year, and many are questioning whether this is the end of the market’s fascination with young artists.

To try answer this question, I have outlined five trends that I think are relevant to what might be in store for 2023:

Trend #1 – Economic uncertainty hurting global sales in 2nd half of 2022, but not unique to the young artist market.

Higher inflation and slower economic growth is likely to have impacted sales in the 2nd half of last year. Auction sales by younger artists fell 58% in 2nd half in 2022, compared to the first six months of the year. However, this trend was not unique to the young artist segment, as the overall contemporary art market was also down 24% from first half. This suggests that the performance of the young artist market was far from an outlier last year, and was instead tied closely to the more established end of the Contemporary market.

Despite a more sombre economic outlook for this year, the market is yet to turn overly pessimistic about the young artist market, and almost half (47%) of experts surveyed by ArtTactic in December 2022, stated they believed that the prices for NextGen contemporary artists were likely to rise over the next 12-months. Only 24% expressed a negative outlook for prices, whilst 29% said they believed the market and prices would plateau in the coming year.

Trend #2 – Asian buying has been cooling, but could it bounce back this year as Covid restrictions are lifted?

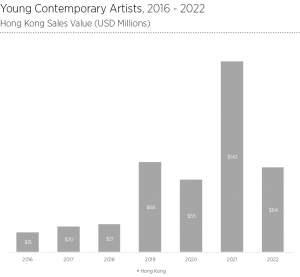

Over the last three years, Hong Kong became an important hub for younger artists, and a significant portion, (37%), of auction sales between 2019 and 2021 was generated in Hong Kong, on the back of strong demand from Asian buyers. A number of top prices by young artists were set in Hong Kong during these years (9 out of top 25 prices), with artists such as KAWS, Adrien Ghenie and Dana Schutz seeing strong demand among Asian buyers.

However, last year, the Hong Kong auction market took a sharp turn for the worse. Auction sales of young artists were down 55% from 2021, however, the number of artworks offered in Hong Kong auction rose from 380 lots in 2021 to 430 lots in 2022. Overall contemporary sales in Hong Kong fell 66% in terms of sales in 2022 and 24% of lots sold. Severe Covid restrictions in Hong Kong and China’s zero-Covid policy is likely to have weighed in on consumer and buyer confidence during 2022. However, Beijing’s recent U-turn away from of its draconian zero-COVID policy, could reignite the market this year.

Trend #3 – More young artists are using the auction market as a natural part of their career development.

Although, last year’s auction sales fell year-on-year, the market still saw an all-time high of 670 NextGen artists featuring in auctions across Christie’s, Sotheby’s and Phillips, up from 476 in 2022. The auction market has become an important tastemaker and influencer in its own right, and artists and their galleries are working more pro-actively with the auction houses in developing a healthy auction market in parallel to the primary market for these artists. We expect the blurring of the lines between the gallery market and auction market to continue, as the two historically separated markets are finding new ways of working more closely together. An example of this was Sotheby’s hiring of Noah Horowitz in 2021 as head of gallery and private dealer services (he has since become the director of Art Basel).

Trend #4 – A young generation of women artists will continue to drive demand

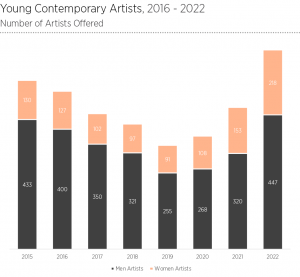

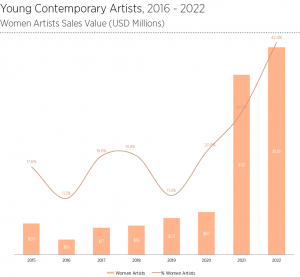

The Young Contemporary generation of women artists have seen auction sales rising steadily in the years from 2015 to 2020, but experienced a jump from $27 million to $112 million between 2020 and 2021 according to a report published by ArtTactic in September. Last year’s auction sales came in 15% higher than 2021 at a record $129 million. This represented 42% of total sales for this generation of artists (compared to 58% by male artists).

The representation of Young Contemporary women artists in the auction market has been rising since 2015. So far 2022 has been a record year for the number of Young Contemporary women artists sold at auction, with 218 featuring in sales this year, up from 153 in 2021 and 108 in 2020. We believe the success of this young generation of women artists will continue to drive demand among collectors worldwide, particularly as many are looking to address the lack of women artist in their collections.

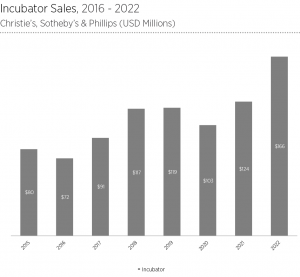

Trend #5 – Young artists bring in young collectors

Although we have seen many young, promising artists coming and going in the auction market over the last two decades, the young artist category is here to stay as it plays a strategic role for the auction houses. Auction sales such as New Now (Phillips), Contemporary Curated (Sotheby’s) and First Open (Christie’s) have provided young artists with a dedicated channel into the global auction market, with unique access to a global collector base. Although these auction ‘incubator’ sales only account for about 10% of the overall contemporary auction market at Christie’s, Sotheby’s and Phillips last year, they do play a strategic role in engaging and cultivating younger buyers, an important objective for most auction houses, as generational wealth is being passed on from baby boomers to millennials and Gen Z.