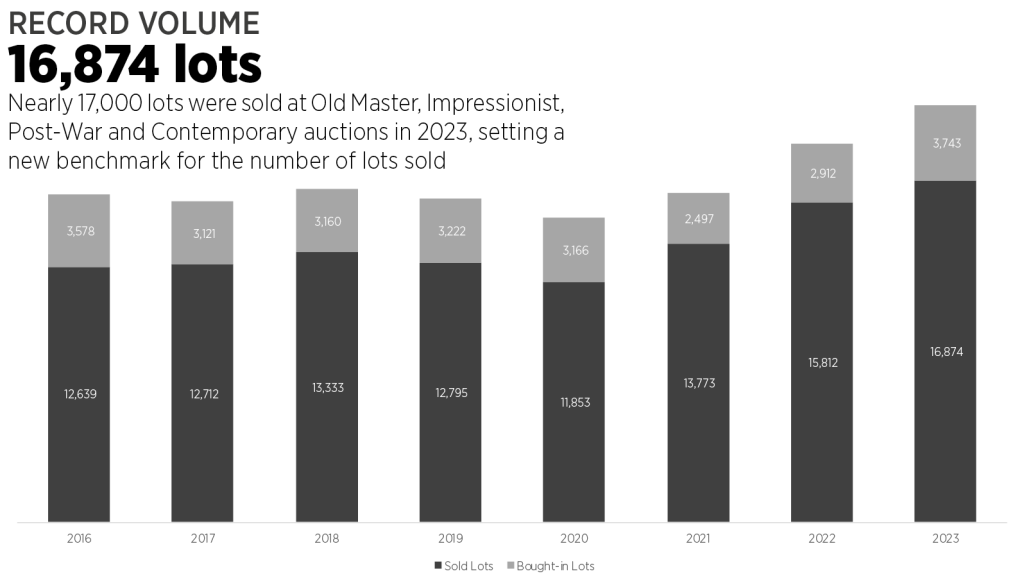

Following what most may characterize as a tumultuous 2023, the Global Art Market faced the dual challenge of both economic headwinds and geopolitical tensions last year. Global auction sales for Old Masters, Impressionist, Modern, Post-War, and Contemporary Art at prestigious houses such as Sotheby’s, Christie’s, and Phillips dipped significantly, marking a 27.2% decrease from 2022 and a 12.4% drop compared to 2021. Despite these lower sale results, a record-breaking number of lots, nearly 17,000 artworks, changed hands – showcasing the resilience and adaptability of the art market moving into 2024.

The year 2023 witnessed a stark contrast in performance between different segments of the market. While the high-end sector, featuring lots valued at $10 million and above, experienced a notable 30% decline, the lower end flourished. Artworks priced below $50,000 saw a remarkable 7.4% increase in sales value, accompanied by an 18.0% increase in the number of lots sold. This shift indicates a growing interest in more accessible and affordable pieces and perhaps illuminates the effects of younger collectors joining the collecting base. Looking to 2024, we predict this area of the market will continue to grow in size and sales value.

The geographical landscape of art sales also witnessed significant shifts. New York, historically a dominant force, faced a 33.3% decline in auction sales, dropping from $5.38 billion in 2022 to $3.58 billion in 2023. In contrast, Paris and Milan experienced growth, with Milan being the sole location boasting positive sales growth at 1.1%. Despite these variations, New York retained its position as the primary sales hub for the global art market, albeit with a reduced market share, followed by London, Hong Kong, Paris, and Milan. As we move into 2024, New York is set to retain its status as the dominant market; however, close attention must be paid toward developing markets, such as Paris and Milan, now experiencing a resurgence of growth following the United Kingdom’s exit from the European Union.

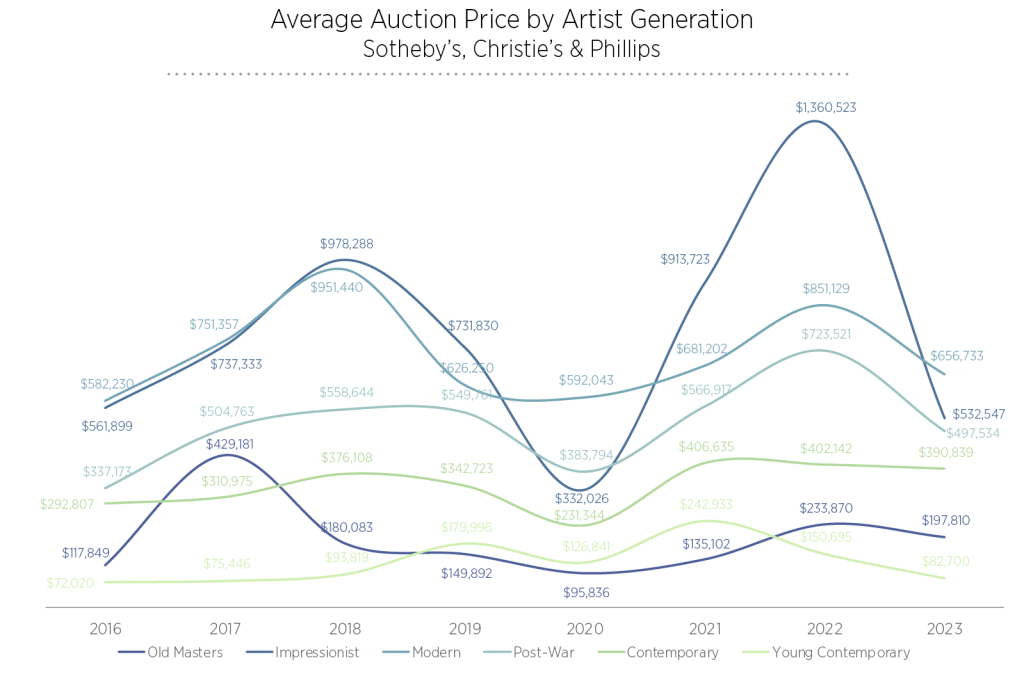

Influenced by these geographical shifts amongst other factors, specific genres within the Global Art Market also faced significant challenges in 2023. The Contemporary market faced a 12.8% decline in auction sales, with notable decreases in the Young Contemporary segment. Artists that achieved record-breaking results in 2022, including Shara Hughes, Flora Yukhnovich, and María Berrío, experienced substantial declines in the sales ranging from 80.5% to 91.8% respectively. Nonetheless, the new generation of Young Contemporary artists, such as Nicolas Party, Matthew Wong, and Jadé Fadojutimi, set new records in 2023, hinting at evolving tastes and trends. The Post-War art sales experienced a dip to a three-year low, with a 31.6% decrease in 2023. Notable artists like Andy Warhol, Cy Twombly, and Lucien Freud contributed to this decline. Post-War art maintained a significant share of total sales despite this, emphasizing the genre’s enduring appeal.

In the Modern art market, sales decreased by 20.4% in 2023. However, the market received a boost from Single Owner Collections, accounting for 32.4% of total auction sales. Artists such as Pablo Picasso, René Magritte, and Mark Rothko remained influential in this segment. Impressionist art sales witnessed a substantial 53.4% drop in 2023, following the record-setting year of 2022. Despite facing challenges elsewhere, the Old Masters market remained resilient, generating a substantial $363.4 million in sales, marking only a marginal 5.3% decline from 2022.

Despite challenges faced geographically and within each genre, the year 2023 marked a continuation of the positive sales trend for women artists. Auction sales by women artists reached $780.4 million, representing an 8.1% increase from 2022 and a substantial 39.1% surge compared to 2021. Women artists accounted for 13.6% of total sales in 2023, reflecting a growing recognition of their contributions to the art world. Unsurprisingly given their significant auction records, woman artists such as Yayoi Kusama, Joan Mitchell, and Georgia O’Keeffe emerged as top performers amongst both their male and female counterparts. This trend should serve as yet another testament to the resilient and thriving presence of women artists in the global art market.

Another notable highlight in 2023 was the cooling of Asian demand for younger artists, particularly in Hong Kong, where auction sales for this generation dropped from $108.1 million in 2022 to $78.2 million in 2023. This shift suggests a potential recalibration of preferences among Asian buyers in the Contemporary art scene.

As the art world steps into 2024, these highlights from 2023 paint a nuanced picture of an industry navigating considerable international challenges while also showcasing resilience, adaptability, and attractive pockets of growth. The convergence of technological advancements and a more inclusive approach to art creation and consumption will play a critical role in shaping the trajectory of the art market in the coming year.

_________________________________

Interested in learning more?

Subscribe to our newsletter below and be the first to know when ArtTactic’s highly anticipated 15th edition of ArtTactic’s Annual Global Art Market Outlook 2024 is released, including expert predictions for the year ahead.

Are you a student or recent graduate eager to contribute your voice to ArtTactic’s Editorial vision? We’d love to hear from you!

Reach out to Brooke Reese (brooke@arttactic.com) for more information.