Moments of Clarity, 2019, Stills from BA Presentation

© Fredrik Tjaærandsen, 2019

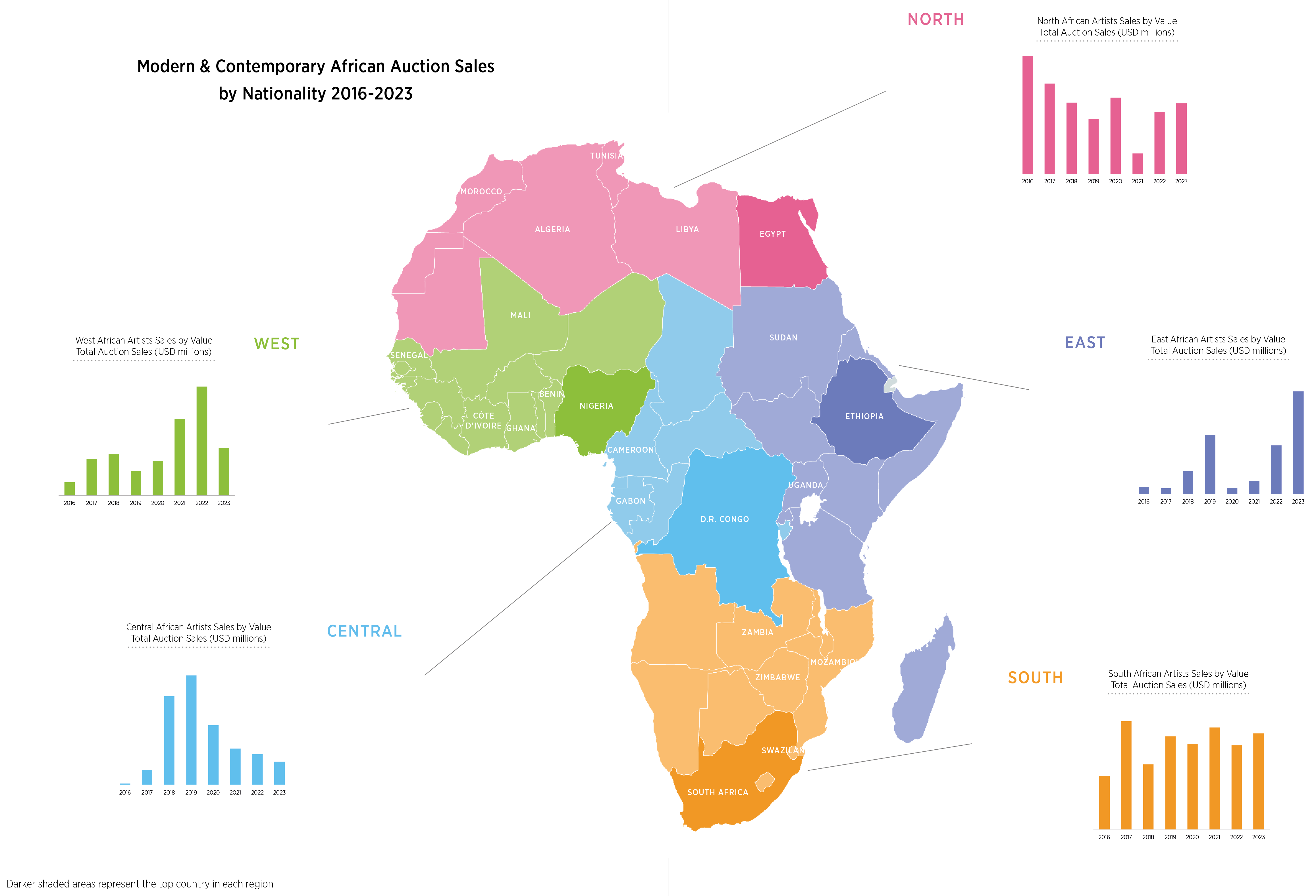

Perspectives Unveiled: 5 Emerging Artists

Overview of art in shaping perspectives

Art holds a unique power to transcend boundaries, provoke thought, and evoke emotions. From the earliest cave paintings to contemporary multimedia installations, art has reflected humanity’s diverse perspectives. In today’s rapidly changing world, where technology connects us more than ever before, art plays an increasingly important role in shaping perspectives.

This article invites the reader on a journey through contemporary art, where the work of five emerging artists who are revolutionizing worldviews and experiences through their art will be explored. These artists, each with their distinctive styles and narratives, offer fresh insights into the complexities of our society, challenging preconceived notions and expanding our understanding of the world around us.

Through their chosen mediums, these artists delve into themes ranging from identity and social justice to environmental concerns and the human condition. Their works serve as catalysts for dialogue, encouraging viewers to question, reflect, and interact with what they are aiming to portray.

Importance of emerging artists

Emerging artists play a vital role in shaping worldviews and influencing societal perspectives due to their fresh perspectives, innovative approaches, and willingness to challenge established norms. Unlike established artists who may already have defined styles and themes, emerging artists often experiment with various mediums and themes, pushing the boundaries of artistic expression. This experimentation allows them to tackle contemporary issues in novel ways, offering unique insights and alternative narratives that resonate with diverse audiences. Additionally, emerging artists frequently come from diverse backgrounds and experiences, bringing a multiplicity of voices and viewpoints to the forefront of artistic discourse. In a world characterised by rapid change and evolving social dynamics, the perspectives of emerging artists serve as crucial barometers of the zeitgeist, reflecting the concerns, aspirations, and struggles of their generation.

Furthermore, emerging artists have the potential to challenge the status quo and disrupt entrenched power structures through their art, advocating for social justice, environmental sustainability, and human rights. By amplifying marginalised voices and shedding light on overlooked issues, emerging artists have the power to spark meaningful dialogue, foster empathy, and inspire positive change on a global scale. In this way, the importance of emerging artists lies not only in their artistic talent but also in their potential to reshape worldviews, challenge assumptions, and contribute to the collective evolution of society.

This article will explore the works of 5 emerging artists from a variety of backgrounds and points in their careers, using a diverse range of media. These artists are Takashi Arai, Gus Monday, Otobong Nkanga, Fredrik Tjaærandsen and Maite Cascón.

May 13, 2012. Misako’s Hibaku Piano (Piano Bombed and Exposed to the Radiation in the Atomic Bombing of Hiroshima in 1954), Daigo Fukuryu Maru Exhibition Hall, Tokyo.

Daguerreotype, 25.2 x 19.3cm. The SFMOMA collection

© Takashi Arai Studio, 2024

Takashi Arai

Takashi Arai stands at the forefront of contemporary photography, seamlessly merging traditional techniques with themes based on memory, technology and historical catastrophes. Born in Kanagawa, Japan, in 1978, Arai’s fascination with the medium of photography began at an early age, inspired by his grandfather’s vintage camera collection and the timeless allure of black-and-white prints. This early exposure ignited a lifelong passion for visual storytelling and spurred Arai to pursue formal studies in photography at Tokyo Polytechnic University.

Arai developed a distinctive artistic style by mastering the origins of the first available photographic process, known as a daguerreotype. Arai extensively studied and taught himself everything there was about this process, and even read the original manuals that were written by Louise Daguerre. The experimentation of traditional techniques in an evolving technological world, brings his work back to the beginnings, reminding his audience of the past through photography. What distinguishes this process is that when standing in front of the pieces, the silver plates that are used to print, create a mirroring effect. Therefore the past can be brought into the present, becoming a catalyst for a discussion around his pieces.

The blue hues within the final photographs remind the viewer of the artists physical involvement to create the final piece and give them a personalised touch. We don’t just see a quick snapshot taken on a digital camera, but a meticulously planned and polished image. It also evokes the idea of radiation after nuclear disasters, a common subject seen throughout Arai’s work.

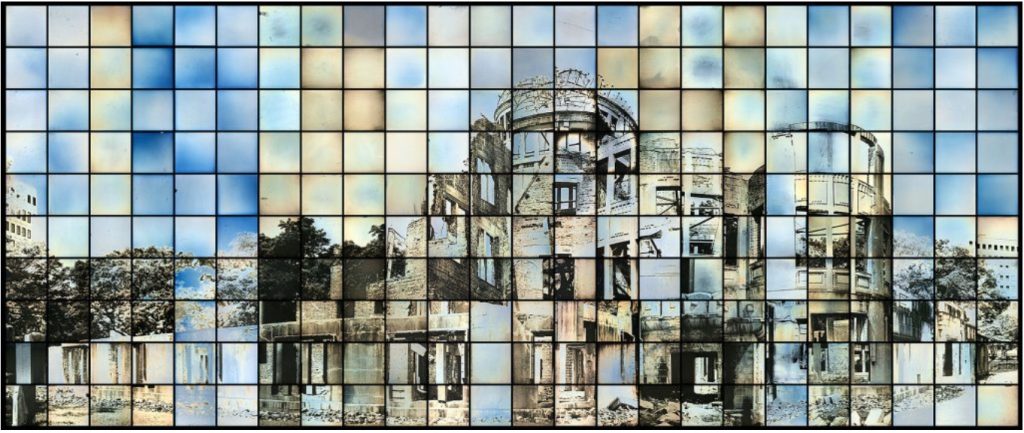

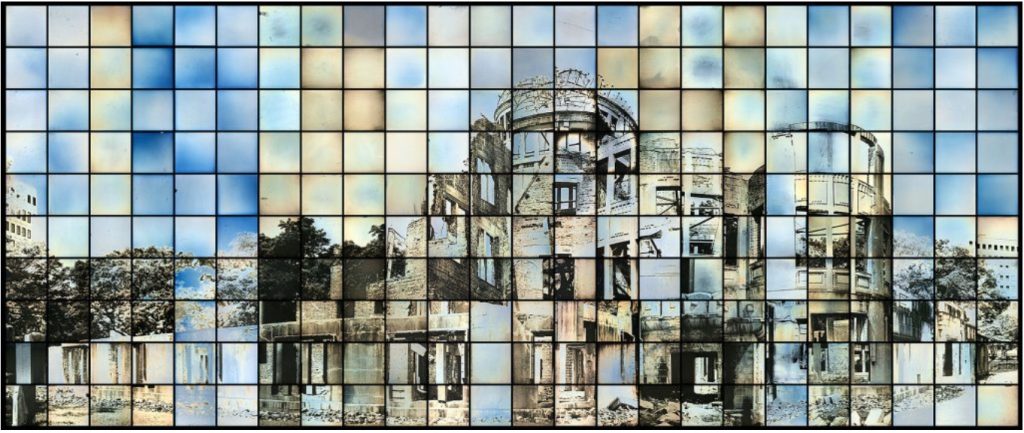

A Maquette for a Multiple Monument for the Hiroshima Peace Memorial (Genbaku Dome)

2014, Daguerrotype, 66 x 152cm. Private collection.

© Takashi Arai Studio, 2024

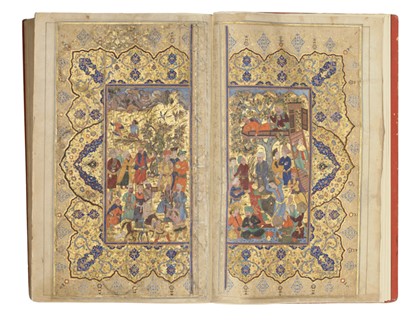

A notable body of work produced by Arai is Exposed In A Hundred Suns (2012). Arai approached monuments that represented a reminder of war, peace or a catastrophe, acknowledged their abstract meaning and created a dialogue within his photographs between the past and our memory of it. This can be seen in his piece A Maquette for a Multiple Monument for the Hiroshima Peace Memorial (Genbaku Dome)

The sophisticated media of the daguerreotype, and Aria’s impressive use of it, allows his viewers to experience the world through carefully chosen scenes while also bringing back memories of what his monuments represent. We don’t just see a quick snapshot of a building, but also the memories of what the monument is there to replace.

Institutional Performance, 140 x 216cm, Oil paint on linen on pine board, 2024

Copyright to Gus Monday, 2024

GUS MONDAY

Gus Monday’s work is largely centred around drawing, craftsmanship and a comprehensive approach to transforming a space and the way we experience it. When he enters a room, Monday observes the atmosphere, how interactions within the space operate, and draws conclusion around the social codes present, that he then generates into visual narratives.

After growing up in South Africa, Monday returned to London to pursue Fine Art at several institutions. Monday has always been socially and culturally sensitive, particularly when he made the transition from a developing country to an economically developed country, shaping the way he observes his surroundings. His artistic journey reflects his inner thoughts, tangible encounters, and keen observations within the spaces he frequently inhabits. Rooted in his inherent anxiety, his artwork often serves as a mirror to his anxious disposition, exploring themes grounded in this emotional landscape. His work remains firmly rooted in the context of his upbringing and experiences, bridging the gap between personal narrative and societal commentary.

Reflection after Bowling’s Mirror, 158 x 122cm, oil paint on linen on pine board, 2024

Copyright to Gus Monday, 2024

His final works offer a surrealist subversion to otherwise identifiable private and public spaces. This can be seen within Reflection after Bowling’s Mirror. Here, viewers are repeatedly drawn to elements they recognize within the constructed setting, yet find themselves unable to fully grasp its intricacies or navigate its dynamics. This marks the beginning of our journey of observation, as we gradually decipher the social cues embedded within this space. With the perspective of the artist in mind, we see the world that surrounds us as an expression of the space.

OTOBONG NKANGA

Otobong Nkanga is a Nigerian-born contemporary artist, working in a variety of mediums including drawing, painting, photography, installation, tapestry and performance. Nkanga’s art explores themes of globalisation, colonialism, and the extraction and distribution of natural resources, with a particular focus on their impact on African countries and communities.

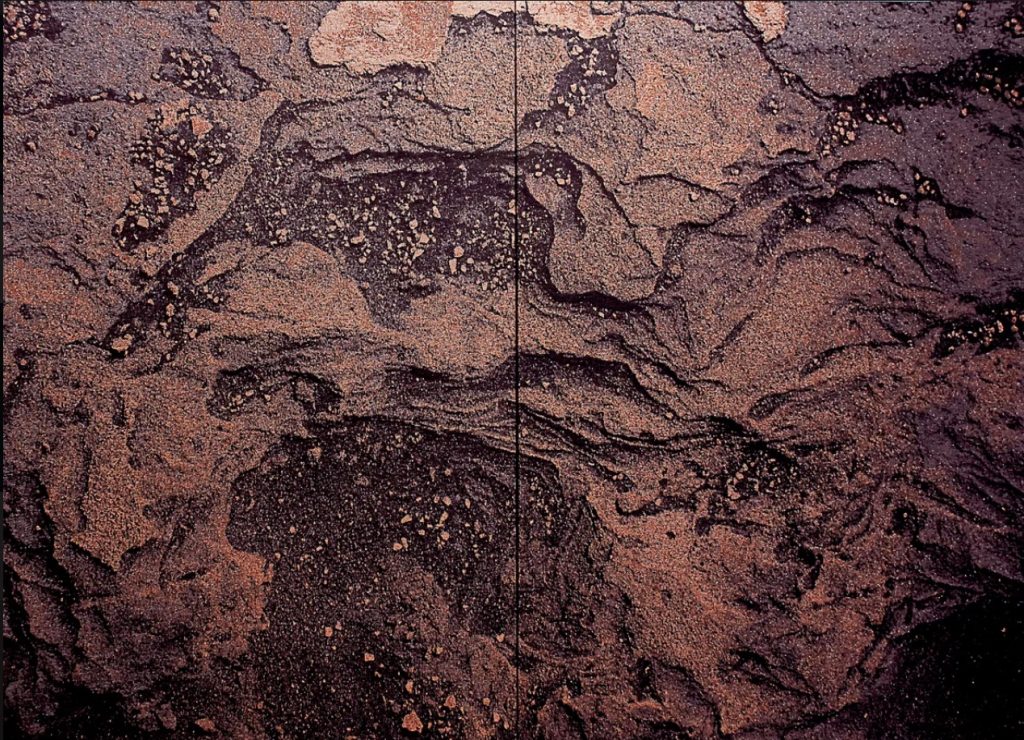

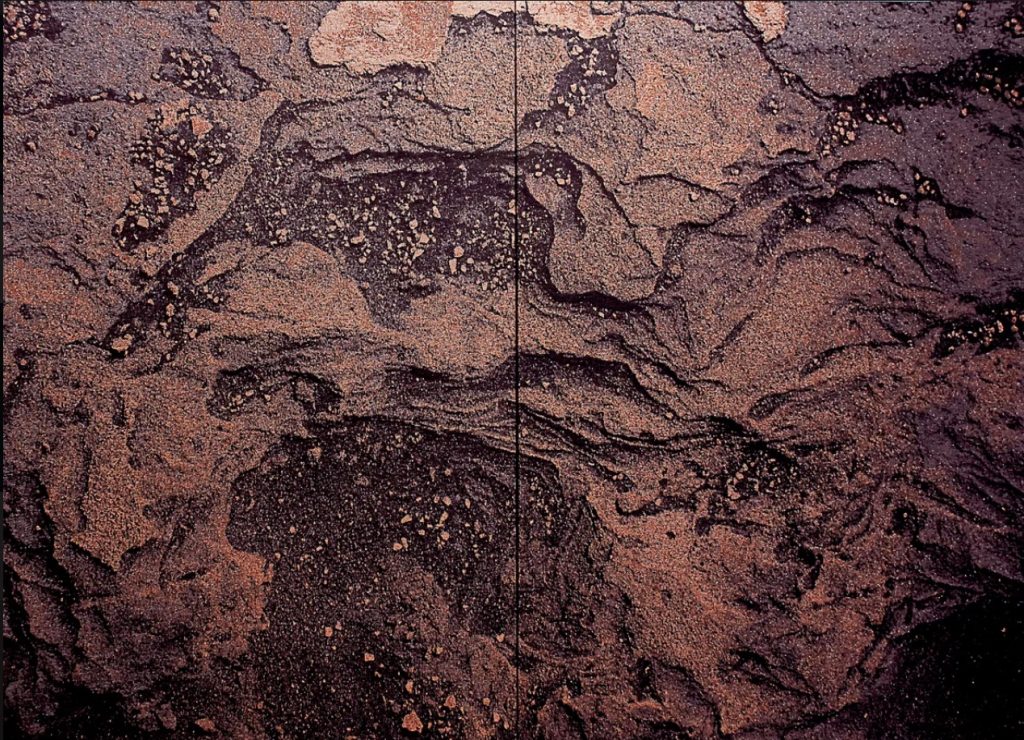

Steel to Rust – Meltdown (2016), Woven Textile (yarns: linen, polyester, merino wool, viscose, rubber Verdi, reflective yarn) mounted on aluminum frames.

Copyright to JTH Studio Management, 2016

Her diverse cultural background and experiences inform her art, which often incorporates found objects, textiles, and organic materials. Nkanga’s work is characterised by its intricate detail and layered narratives, inviting viewers to contemplate issues of identity, memory, and the environment.

Throughout her career, Nkanga has addressed issues of sustainability and has been an advocate against climate change through her works, as they depict the reality of humanity’s effect on the environment. Her work, Steel To Rust – Meltdown (2016), which has been acquired by the Bonnefanten Museum in Maastricht, is a great representation of this. Her hopes for the future are depicted in this intricate tapestry which examines the lifecycle of steel, from its production to its eventual breakdown and return to nature. This once-industrial material has broken down and decayed, returning to the replicated nature and the erosion that life has on landscapes. The piece creates an optical illusion of being three-dimensional and only when stepping closer, the viewer can recognise the medium in which it has been made. Questions of manual labour arise through the industrial material that is being mimicked, and the delicate woven technique that is used to make this artwork.

FREDRIK TJÆRANDESEN

Fredrik Tjaærandsen is a cutting-edge contemporary artist known for his imaginative and thought-provoking explorations of fashion, sculpture, and performance art. Born and raised in Norway, Tjærandsen’s artistic trajectory has been marked by bold experimentation and a strong interest in the intersection of art and fashion. His work transcends boundaries of what one would consider art in the traditional sense, creating spaces that leave audiences in awe.

One of Tjaerandsen’s most significant works is his 2019 “Bubble” dress collection, which went viral on social media and earned him international attention. These transparent-coloured latex inflatable garments were designed to engulf one’s body in a bubble-like cocoon, blurring the lines between fashion, sculpture, and performance.

Moments of Clarity, 2019, Stills from his BA Presentation

Copyright to Fredrik Tjaærandsen, 2019

Beyond their aesthetic appeal, Tjærandsen’s creations also invite viewers to reflect on themes of protection, vulnerability, and the fragility of the human form. By subverting expectations and pushing the limits of what clothing can be, he prompts audiences to reconsider their relationship to their bodies and the garments they wear.

GYDA, 2022, 1000cm x 1000cm x 400cm, Latex

Copyright to Fredrik Tjaærandsen, 2022

Beyond clothing, these ideas of vulnerability are also punctuated within installation pieces. The body once again becomes the subject central to the performative nature of his work, as one can enter the immersive experience of The Core. The Core was a performance piece made in collaboration with a choreographer, Guro Nagelhus Schia and Vebjørn Sunby and the music made by Brent Isak Wærstad. This installation spans over several rooms with music and dance performances creating a symbiosis between the two. The audience is confronted with strangers also travelling along these spaces and are forced to interact with one another through this intense journey.

Not only do his works give off the aesthetic appeal of innovative fashion, they also bring together the dialogue created when these pieces are experienced by the performance of the model on a runway or photo shoot, and the immersive exploration of the body that has never been seen in such a way before.

MAITE CASCÓN

Maite Cascón is a Madrid born artist who has established a growing following and recognition within the world of printmaking and drawing. Through her artistic process, she reconstructs reality by manipulating sketches, crafting scenes that defy the limits of possibility. Drawing inspiration from psychoanalysis and folklore, she explores themes deeply ingrained in her upbringing in a Catholic, male-dominated society.

Exploring these subjects allows her to confront conflicts within her immediate surroundings and analyse inherited behavioural patterns. Her artistic themes primarily revolve around the human body, mortality, and various social issues including gender, sexuality, violence, the detachment from nature, and the rise of individualism in society. Her whimsical and playful approach to her artistic process, coupled with the incorporation of metaphors in her creations, enables her to unveil the untamed aspects of human nature and tackle these subjects in a ground breaking manner.

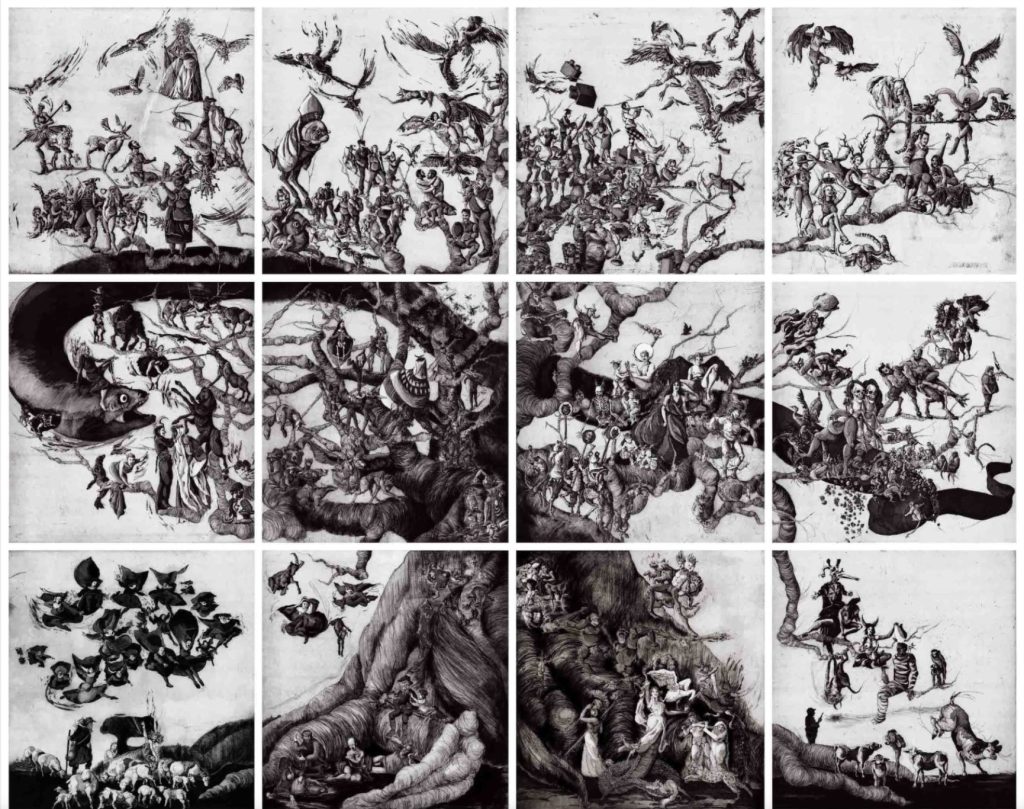

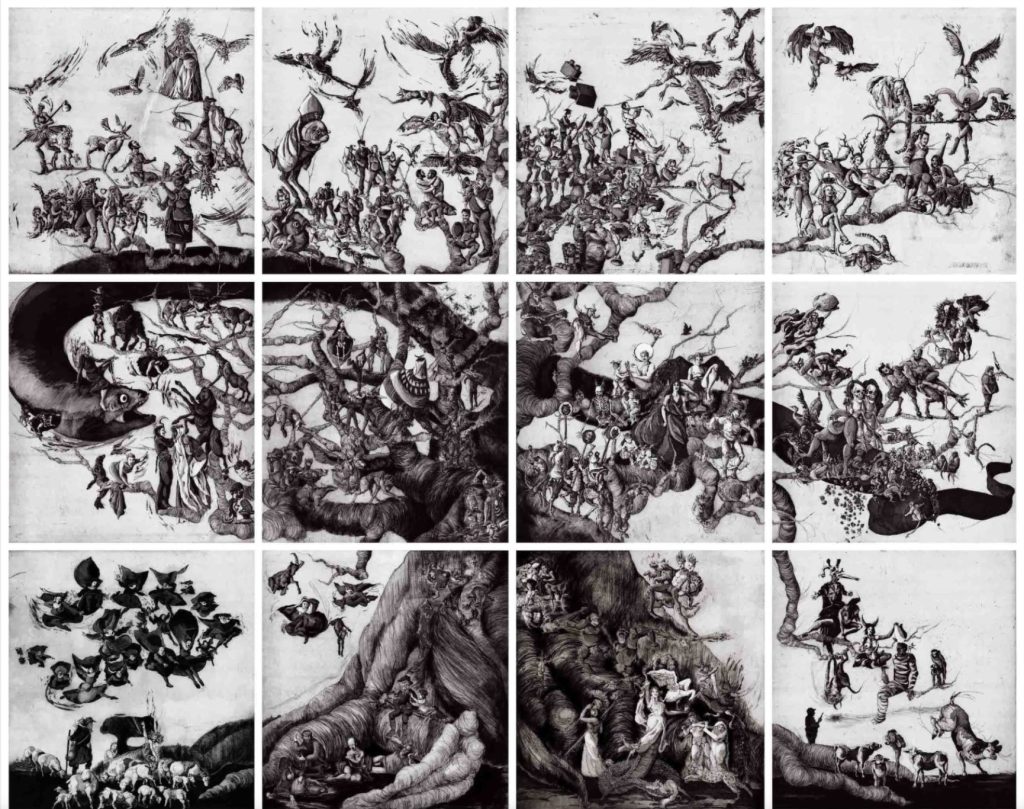

The Trickster’s Tree, 2021, Etching, aquatint and drypoint,

combined paper size: 1800 x 1500mm

Copyright to Maite Cascón, 2021

One of her most recent artworks, Trickster’s Tree (2021), is composed of 12 individual printed panels that come together to form an installation that is based on the subject matter of the Trickster Jungian Archetype. This is a figure that embodies mischief, unpredictability and the breaking of social norms. Maite uses this archetype to elevate her works and represent the disrupting of order and introduces chaos into the established system of society.

All twelve elements work individually, but when showcased together, the flow of narrative and details make it hard to comprehend at one quick glance. Her work is representative of the complex world views of our society, but brings back the foundations of stories through her folk inspirations.

Final Thoughts

Emerging artists will always hold unique perspectives to the world around us; the way that they decide to depict it can be extraordinary. The exploration of the works by these five emerging artists illuminates the profound impact that art continues to have on shaping perspectives in our contemporary world. From Takashi Arai’s evocative daguerreotypes that bridge the past and present to Gus Monday’s introspective narratives on space and social dynamics, each artist offers a unique lens through which to view and understand the complexities of our society.

Otobong Nkanga’s intricate tapestries and installations prompt reflection on global issues such as environmental sustainability and the impact of colonialism, while Fredrik Tjærandsen’s boundary-pushing creations challenge conventional notions of fashion and vulnerability. Finally, Maite Cascón’s whimsical yet thought-provoking artworks delve into the depths of human nature and societal norms, inviting viewers to reconsider established paradigms.

Collectively, these artists demonstrate the power of art to spark dialogue, foster empathy, and inspire positive change. As emerging voices in the artistic landscape, their fresh perspectives and innovative approaches serve as vital catalysts for shaping worldviews and influencing societal perspectives. In a world characterised by rapid change and evolving social dynamics, the contributions of emerging artists like Takashi Arai, Gus Monday, Otobong Nkanga, Fredrik Tjærandsen, and Maite Cascón are indispensable in guiding us towards a more nuanced and inclusive understanding of the world around us.

Are you a student or recent graduate eager to contribute your voice to ArtTactic’s Editorial vision? We’d love to hear from you!

Reach out to Sandy Dewar (sandy@arttactic.com) for more information.