Spanning over 14 centuries, 3 continents and a multitude of mediums, pre-modern Islamic art as an overarching term for “art made by and for people who lived or live in lands where the majority were Muslims” (Bloom & Blair, 1997) constitutes one of the most geographically, temporally and material diverse markets in today’s art world. Despite headline-maker lots such as the US$14.9 million (hammer price) Tipu Sultan’s sword, the US$8 million Shahnama folio, and the US$7.8 million brass candlestick, the market has in fact witnessed a volatile year-on-year movement, both in terms of sales value and volume. As the Islamic art week approaches, this article will look back at the market trajectory of the past 10 years, and ahead at the trends of collecting and investing in this broadly defined category, amidst the ongoing geopolitical tensions and budding cultural happenings in the Gulf regions.

Tipu Sultan’s Sword, Bonhams, 2023

In 2023, Sotheby’s, Christie’s and Bonhams pre-modern Islamic art offerings in London fetched a total of US$57 million (hammer price), among which Bonhams stood out with a skyrocketing 936.8% gain from the year before. The dominating force is evidently the 18th century Bedchamber Sword of Tipu Sultan, almost doubling the previous record of the most expensive Islamic object sold a year ago and making 7 times its US$1.86 million low estimate. Sotheby’s and Christie’s, on the other hand, nudged a 0.1%* increase and a 54.8%* drop respectively. Beside last year’s pressure from global economic crunch and wars, there seems to be a persistent push-and-pull market dynamics between Christie’s and Sotheby’s – when one heads upward, the other downward (except for the year of Covid). In 2022 and 2021, Christie’s scored consecutive growth of 58.7% and 24.9% after a year of contraction. Alternatively, an inverted pattern speaks for Sotheby’s, where a 24.7% fall in 2022 was followed by a year of headway and 2 years of decline. Such an inconclusive performance signals a mercurial buyer inclination towards the sellers, especially those who collect higher-value work. As for sales volumes, both auction houses experienced decline in total lots sold in 2023, with Christie’s shrinking to only a fifth of its peak in 2016 and that of Sotheby’s to 60%. Sell-through rate remains at the 55% level for Sotheby’s and a 4-year low for Christie’s, at 67.7%.

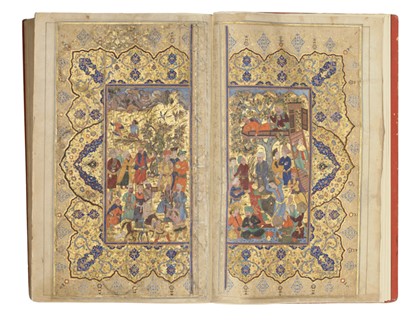

The Khamsa of Nizami and Amir Khusraw Dihlav, Christie’s, 2024

Between the blockbuster outperformers and regular curations, Persian carpets, Mughal and Safavid book arts and Iznik pottery continue to attract most bids, bringing in lofty above-estimate trade figures to the auction market. Following this trend, lots of particular interest in the upcoming sales include: a folio from the Late Shah Jahan Album in the Mughal period at Sotheby’s, the large Safavid figural velvet panel, and the Khamsa of Nizami and Amir Khusraw Dihlav at Christie’s, reaching a combined estimate range of US$1.3 million to US$1.8 million. Outside of London, Tajan’s Oriental and Islamic Sale in Paris and Oriental Art Auctions’ Fine Islamic Art Sale in the Netherlands both achieved optimistic estimate-beating results, raising half a million to over a million annually. In addition to the continental counterparts, regional presence such as Christie’s Dubai and Qatar’s AlBahie Auction House are materialising exciting opportunities, along with mega museums and buzzing educational programmes. If London wishes to continue its success in this evolving landscape, perhaps it’s time to lean less towards the legacy, but more towards finding relevance in a diverse market that will be driven by fresh perspectives and value-based motivations among the next generation of collectors and art enthusiasts.

*Net of Orientalist paintings, Indian paintings and private collections with mixed categories.

Are you a student or recent graduate eager to contribute your voice to ArtTactic’s Editorial vision? We’d love to hear from you!

Reach out to Brooke Reese (brooke@arttactic.com) for more information.