Original Image: Bathers (1874-75) by Paul Cézanne. Metropolitan Museum of Art, New York. Image courtesy of Metropolitan Museum of Art.

“The future of the online art market is guaranteed, although the shape remains a mystery.” – Robert Read, Head of Art & Private Clients at Hiscox

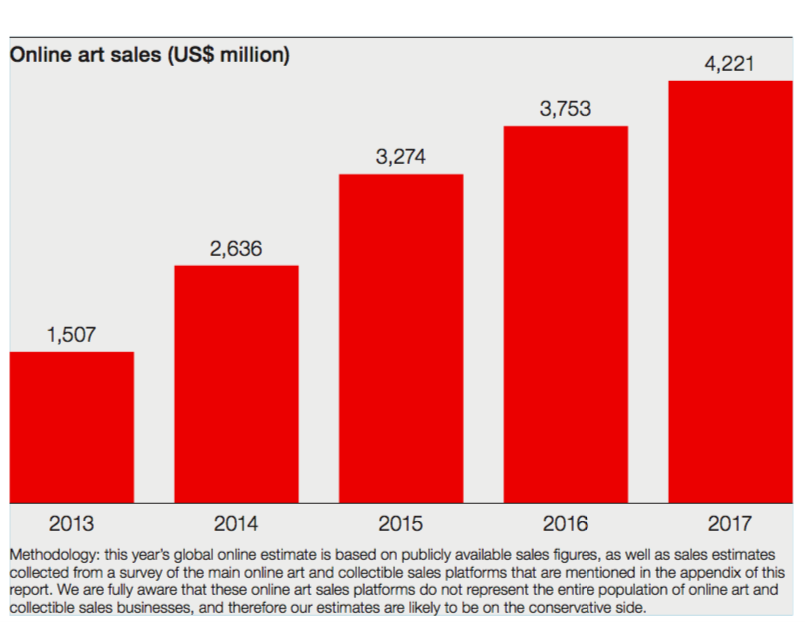

The sixth edition of the Hiscox Online Art Trade Report 2018, released just last week, has sparked many interesting conversations about the current and future state of the online art market. This year’s report findings, which are based on the responses of over 800 art buyers from ArtTactic’s client mailing list, reveal that while the market is still growing, it is slowing. The online art market reached an estimated $4.22 billion last year, which is a 12% increase from the year before. Although this is certainly less growth than the 15% increase in 2016, and the 24% growth rate of 2015, it seems that the online art market is stabilizing as it becomes a more established sector of e-commerce.

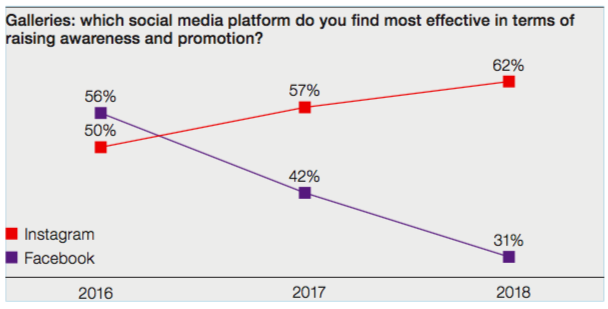

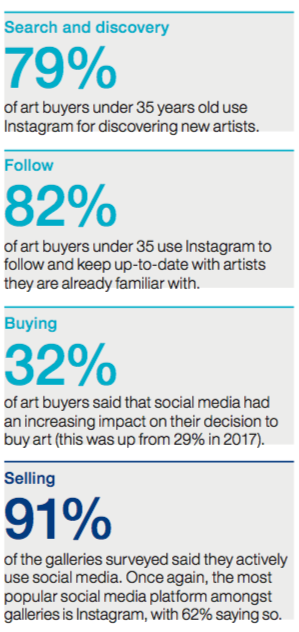

The report also found that confidence is increasing among repeat customers, with evidence that buyers are not only buying more frequently online, but at higher prices. The number of online art buyers paying an average price in excess of $5,000 per art object increased from 21% in 2017 to 25% in 2018. Another key finding includes the increase of mobile devices when buying art, which climbed from 4% in 2015 to 20% in 2018, and is in line with the overall doubling of mobile web traffic from 2014 to 2018. Additionally, Instagram has been crowned king of social media platforms, with 63% of survey respondents citing it as their platform of choice, which is an increase from 57% in 2017 and 48% in 2016. In keeping with the times, the report also offers statistics on increasingly important emerging areas of risk and opportunity, such cyber crime, data protection regulations, and blockchain.

However, for those interested in extrapolating about the future of the online art market, one of the most important sections of the report focuses on the buying habits of Generation Y (20-35 years), also termed “millennials”. Roughly 43% of buyers surveyed belonged to Generation Y, and 25-29 year olds alone represented an astonishing 20% of all buyers. Not only that, but the online buying habits of this age range is set to increase next year, with 63% of Gen Y buyers saying they intend to buy more art online than last year (compared to 52% of all respondents in 2018).

More specifically, the data about this younger demographic’s buying habits and preferences could be quite good news for online galleries. While 44% of Gen Y buyers said they preferred the experience of buying in a physical space more, approximately the same percentage (43%) claimed to not have a preference between a physical and online gallery. Meanwhile, 14% actually preferred the experience of buying online. With a combined 57% of Gen Y buyers either preferring the online experience or not having a preference at all, it seems like a brick and mortar gallery space is becoming less important for a younger generation of collectors.

Findings about the social media habits of millennials support the overall trend that Instagram has eclipsed Facebook as the preferred channel, with quite a dramatic turnaround in only the past two years of the survey. In 2018, 62% of galleries prefer Instagram while only 31% prefer Facebook.

Millennial art buyers’ support for Instagram was overwhelming, and has major repercussions for the way that artists themselves use the platform to promote their work. The report found that 79% of art buyers under 35 using the platform to discover new artists, while 82% use it to keep up-to-date with artists they are already familiar with. Overall, 43% of Gen Y buyers reported to be influenced by social media when buying art. With close to 1 billion users, Instagram is becoming an essential tool for the art industry in reaching consumers beyond the existing art market. The important question is, with social media trends changing so quickly, will Instagram stick in years to come? The answer for Instagram most likely lies in maintaining the loyalty of the Gen Y demographic.

The question of how to build an online art market that addresses the needs of this age group is not an easy one. Most millennials were introduced to the online market place at a fairly early age and consider easy-to-navigate sites and fast shipping to be the norm. While buying and selling art online may present more challenges compared to other commodities such as clothing or food, the high expectations of these other more established online industries will most likely transfer to the online art market, and younger collectors will probably expect their art purchases to be delivered to their door just as seamlessly as their take-away dinner.

As the world of e-commerce grows, increasingly advanced marketing tactics such as personalization and localization are becoming the norm. However, the art world will be pleased to know that despite all of these outside considerations, the most crucial factor for buying art online for millennials, and buyers of all ages, is the quality of the art itself.

As long as the online art market is prepared to face challenges (cybercrime and data protection laws) while simultaneously embracing and incorporating cutting edge technologies into their business models (AI and blockchain technologies), the online art market should continue to thrive. The growth in new partnerships between online platforms such as Artsy, Invaluable and LiveAuctioneer and traditional art businesses (auction houses and galleries) is a positive sign that the art world is adapting to an increasingly technological business environment.