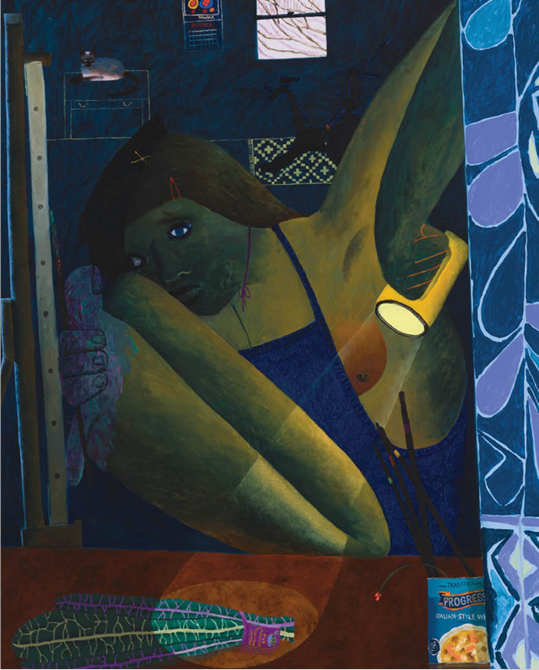

Detail of Celeste Rapone, Interior with Egyptian Curtain and Kale (after Matisse) (2021)

The 10th edition of the Hiscox Online Art Trade Report provides new insights into current online art buyer behaviour, and explores some of the new trends emerging. Here are five key trends that could shape the market over the coming 12 months…

Trend #1 – Industry consolidation on the cards as online sales slow down:

Significant investments were made during 2020 and 2021 to meet the increasing online demand for art and collectibles, and this has left online art marketplaces with an enlarged cost base in what now looks to be a slowing market. With limited access to financing options going forward and investors wanting to liquidate their assets, one could expect an increasing level of M&A activity this year. 71% of the online platforms surveyed said they anticipated more consolidation taking place in the next 12 months, compared to 64% who said the same in 2021.

Trend #2 – The economy starts to bite

Whilst the $1m+ market continues to see strong demand among the ultra-wealthy, art buyers at the lower end of the market, are likely to scale down their buying activity this year. Slower growth, rising inflation and higher interest rates are likely to have an impact on online buying this year. With 30% of art buyers saying they will buy less, as they have less disposable income to spend on art. This was higher among younger art buyers (32%) and new art buyers (35%).

Trend #3 – Climate concerns are likely to affect buying behaviour in the future:

Although, the majority (54%) of art buyers express little or no concern regarding the environmental impact of buying art online, the remaining 44% said that they were likely to change their future online art buying behaviour as a result of the environmental impact. The younger generation worries predominantly about shipping, with 64% saying that air freight was their main concern followed by 60% mentioning packaging as a key issue. Half (51%) of online art buyers said they would change their online art buying behaviour due to environmental impact, with a third of young buyers saying they would buy art locally, and another third said they would only buy art online, if sea-freight was being used or zero-emmission vehicles. Almost a third (32%) of all art buyers said they would be prepared to pay more for a more sustainable option of buying art online (and even higher share (35%) of young buyers said the same.

Trend #4 – Fractional ownership attracts interest

Over the last 12 months, fractional ownership in art has gained popularity. So far the adoption in the art world has been low, but could this change this year? Although, only 9% of the art buyers surveyed said they had invested in a fractional ownership in art or collectible over the last 12 months, 61% of art buyers said they were likely to invest in fractional ownership in artworks in the coming 12 months (78%, of younger art buyers said the same). This suggest that the perception of fractional ownership as a viable ownership and investment model is on the increase, and we could anticipate more demand and wider adoption this year. With the global economic outlook remaining uncertain, investors are increasingly looking for portfolio diversification, and 86% of those art buyers that are considering investing in fractional ownership over the next 12 months, are looking at their investment from this perspective. Despite its promises, almost three quarters (74%) of potential investors in fractional ownership of art said that lack of liquidity was the main challenge, followed by 41% who said lack of transparency and prohibitively high costs were key risks in this market.

Trend #5 – NFT collectibles lose their shine, but have paved the way for wider adoption

A year ago, many had still large hopes about the potential of NFTs. However, only 12% of art buyers surveyed said they are likely to buy an NFT in the coming 12 months (down from 27% in January 2022), with both younger and older buyers showing similar level of caution about this year’s outlook. Whilst the value potential was still the highest ranked motivation (66%, but down from 82% in 2022) among NFT art buyers in 2023, the expectations seem to have become more muted, as NFT prices and sales have dropped significantly. Motivations linked to social impact and patronage have increased from 39% in 2022 to 54% this year. More people are also seeing the community benefits as a strong motivator, with 44% saying that the network and being part of a community of like-minded people was a key reason for buying NFTs, up from 38% in 2022. The art market is starting to take a more mature look at the technology, and rather than looking at NFTs as collectibles and speculative investments, is now pursuing strategies for how the technology can develop new models and help build a better infrastructure for its stakeholders.