Banksy, This is Not a Photo Opportunity (2007) – annual return of 14.7% over 14 years (sold at Sotheby’s New York in May 2022)

Inflation figures are heading into double digits, and stock markets and crypto currencies have been in freefall since late March. However, the art market has shown strong resilience so far, and is gaining increasing attention from investors. Social media is currently flooded with art investment related ads, and fractional ownership platforms, like Masterworks and Mintus, are gaining in popularity among a new generation of art investors.

Last week we saw the end of the New York Marquee Auction Week, which raised a total of $2.06 billion in evening sales (see our latest ArtTactic auction report). Almost a third of the lots in these sales returned to the auction market for the second or third time. So what insights are these repeat sales giving us about the nature of art investment returns, and what could investors expect from the market ahead? We ran the figures in our latest Auction Resale Report, and here are a few takeaways…

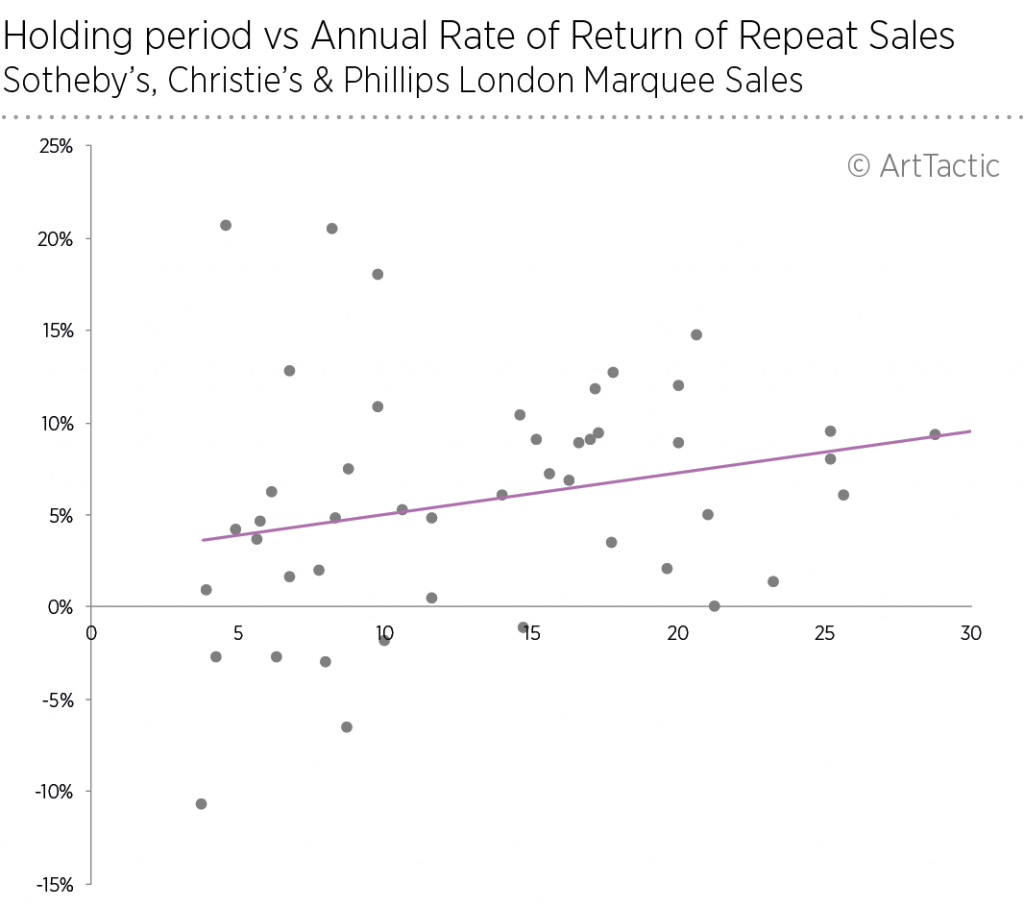

Don’t buy at auction if you plan a quick resale: Art buyers generally don’t like to see art works bought at auction appearing back on the auction block within a 5-year period. Our data suggests that the risk of a loss is significantly higher during this period. So if you plan to flip the art back onto the market – you either need to source the work in the primary or private market and sell it in the auction market, or buy it in the auction market and hope to sell it for a higher price in the private market. However, this could prove difficult for many ‘trending’ artists, as auction prices are already inflated.

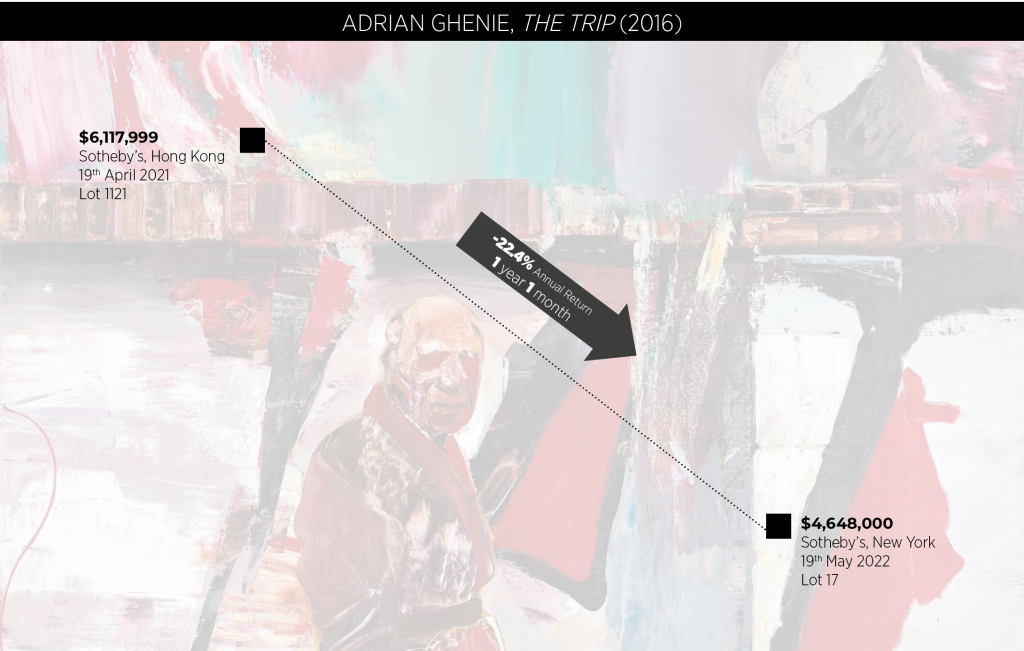

Art investment requires time: The average holding period for art resold during the New York Marquee auctions was 25.5 years, with 72% of the repeat sales having been away from the auction market for at least 15 years. Shorter holding periods shows mixed results, with 3 out of 7 lots held for less than 7 years selling below their original auction price. Among these was Adrian Ghenie’s The Trip (2016), which initially sold for $6.1 million in May 2021 in Hong Kong, and again for $4.6 million in May 2022 in New York, a loss of 22.4% in one year, despite no apparent weakness in his overall market.

Blue-chip art shows stable returns: 75% of the repeat sales we studied from the last round of auction sales were from the blue-chip segment of Impressionist, Modern and Post-War artists, with the remaining quarter linked to Contemporary artists. The average annual return for the Contemporary art repeat sales were 7.3% (holding period 12.2 years) compared to 5.3% for Impressionist art, 7.3% for Modern art and 9.5% for Post-War art, with an average holding period of 28 years for these three collecting categories.

Art vs Equity: The 82 repeat auction sales in New York generated an average annual return of 7.1% (not adjusted for inflation), with an average holding period of 25 years, whilst the S&P 500 returned 6.6% annually over the last 25 years. Art returns have so far this year given a healthy profit to their long-term owners, and is likely to continue to attract further interest among investors.

So if you are looking to invest, make sure you take a long-term view and enjoy the art in the meantime!